Is Living in Central Tokyo Still Affordable?

Rising Property Prices Challenge Residents as Demand and Development Reshape the Capital

By Japan News Desk | September 29, 2025

Cost of Urban Life Under Scrutiny

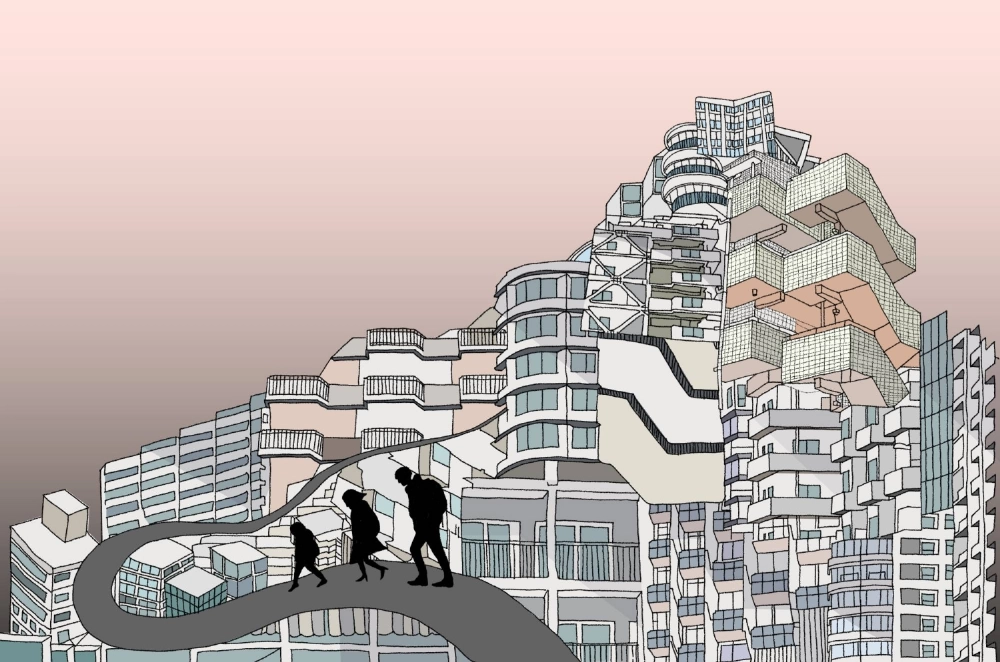

TOKYO — As central Tokyo’s skyline stretches ever upward with gleaming new towers, the question of affordability looms large for residents, with property prices surging to levels unseen in over three decades, driven by a potent mix of foreign investment, post-pandemic demand, and ambitious redevelopment projects. The average price of a new condominium in Tokyo’s 23 wards hit ¥112.7 million in August, a 17.5 percent jump from last year, marking the highest since tracking began in 1990, according to the Japan Real Estate Institute.

This escalation reflects a citywide trend where central districts like Minato and Chiyoda see prices soar, with luxury units in areas like Roppongi and Toranomon fetching over ¥200 million due to proximity to business hubs and international schools. The influx of foreign buyers, particularly from the U.S. and China, has fueled a 30 percent rise in transactions since 2023, as wealthy expatriates and investors snap up properties amid a weakened yen, now hovering around 150 to the dollar.

Redevelopment projects, such as the Toranomon-Azabudai complex with its 64-story Mori Tower, have further intensified pressure. Completed in 2023, this ¥580 billion development added 5,500 residents and office workers, boosting local demand and pushing nearby rents up 15 percent. Similar projects in Shinjuku and Shibuya, including a 54-story tower set for 2026, promise modern living but shrink affordable housing stocks as older buildings make way for high-end replacements.

For locals, the impact is palpable: monthly rents in central wards average ¥200,000 for a two-bedroom apartment, double the national figure, while first-time buyers face mortgage burdens exceeding 40 percent of income in some cases. Real estate agents report a shift, with young families and middle-income workers increasingly priced out, relocating to suburbs like Saitama or Kanagawa, where prices remain 30-40 percent lower.

As of September 29, 2025, Tokyo’s property market buzzes with opportunity for investors but starkly highlights affordability challenges for residents. With no immediate policy relief in sight, the capital’s allure as a global metropolis risks alienating the very community that defines its soul.

Property Boom Tests Tokyo’s Livability

Tokyo’s skyrocketing property prices, with new condos at ¥112.7 million and rents at ¥200,000 monthly, signal a market thriving on foreign cash and redevelopment, yet this boom strains middle-class residents, pushing them to suburbs as central wards morph into playgrounds for the wealthy, threatening the city’s diverse social fabric.

The 17.5 percent price surge since last year, driven by 30 percent more foreign transactions and projects like Toranomon’s ¥580 billion tower, underscores a disconnect: while investors profit, locals face 40 percent income mortgages, with suburbs offering relief but eroding urban vitality, a trend demanding policy attention as of September 2025.

This economic shift, fueled by a weak yen and global demand, challenges Tokyo’s identity, balancing growth with accessibility in a city where affordability once defined its charm.

Impact of Rising Condo Prices

The average new condo price in Tokyo’s 23 wards reached ¥112.7 million in August, up 17.5 percent from 2024, the highest since 1990, with luxury units in Minato and Chiyoda exceeding ¥200 million, pricing out many local buyers amid a real estate frenzy.

Role of Foreign Investment and Redevelopment

Foreign buyers from the U.S. and China have driven a 30 percent transaction rise since 2023, while projects like Toranomon-Azabudai’s 64-story Mori Tower, completed in 2023, and a 2026 Shinjuku tower, have lifted rents 15 percent, reshaping central Tokyo’s housing landscape.

Suburban Shift Among Residents

Young families and middle-income workers, facing central rents of ¥200,000 monthly and high mortgages, are moving to Saitama and Kanagawa, where prices are 30-40 percent lower, altering Tokyo’s demographic balance as affordability erodes.

Expert and Resident Voices

“The average price of a new condominium in Tokyo’s 23 wards was ¥112.7 million in August, up 17.5% from last year and the highest since tracking began in 1990, reflecting a market surge that’s making homeownership a distant dream for many Tokyoites.”

“Foreign buyers, particularly from the United States and China, have been a major driver of the market, with transactions increasing by about 30% since 2023 as the yen weakened to around 150 to the dollar, pushing up demand for luxury properties in central areas.”

“The completion of the Toranomon-Azabudai project in 2023, a ¥580 billion development with a 64-story Mori Tower, has added about 5,500 residents and office workers to the area, contributing to a 15% increase in nearby rents and further straining affordable housing stocks.”

“A 54-story skyscraper is set to be completed in Shinjuku in 2026, and similar large-scale projects are planned or underway in Shibuya, indicating that the supply of affordable housing will continue to shrink as developers prioritize high-end developments.”

“Monthly rents in central Tokyo wards now average about ¥200,000 for a two-bedroom apartment, more than double the national average, forcing young families and middle-income workers to consider relocating to suburbs like Saitama and Kanagawa, where prices remain significantly lower.”

Historical Context of Tokyo’s Property Trends

Tokyo’s property market soared in the late 1980s bubble, crashing by 1990, but the current rise—¥112.7 million condos and 17.5 percent growth—marks a new peak since then, driven by post-2020 pandemic recovery, foreign investment, and redevelopment, contrasting with the 2010s stagnation when prices hovered 20 percent lower.

The weak yen since 2022, hitting 150 to the dollar, has amplified foreign buying, while projects like Toranomon-Azabudai echo 1960s urban expansions, though today’s focus on luxury shrinks affordable stocks, echoing pre-bubble displacement patterns as of September 2025.

Future Outlook for Affordable Living

Without policy shifts like rent caps or subsidized housing, central Tokyo’s affordability may erode further, pushing residents outward; developers’ 2026 plans suggest a continued high-end trend, but community advocacy could spur affordable units, balancing growth with livability.

As Tokyo evolves into a global hub, its affordability challenge tests its soul—can it remain a home for all, or will it become a playground for the elite, a question hanging over its bustling wards today?

Categories, Keywords, and Sources

Categories: Japan Real Estate, Tokyo Housing, Affordability Crisis, Property Market, Urban Development

Keywords: Tokyo property prices 2025, affordable living Japan, foreign investment Tokyo, Toranomon redevelopment, rising rents central Tokyo

Source: The Japan Times | For more on Banzai Japan news, visit our homepage.